3 Things Your Sponsors Will Love About FanX

From activating branded offers to gaining invaluable insights through measurable data analytics, FanX offers a comprehensive platform...

From activating branded offers to gaining invaluable insights through measurable data analytics, FanX offers a comprehensive platform...

Since launching their app, Emily Punt and her team at Augustana are maxing out their fan engagement...

Cash In Your Points Snap! Store is the fan store that gives back! You can now withdraw...

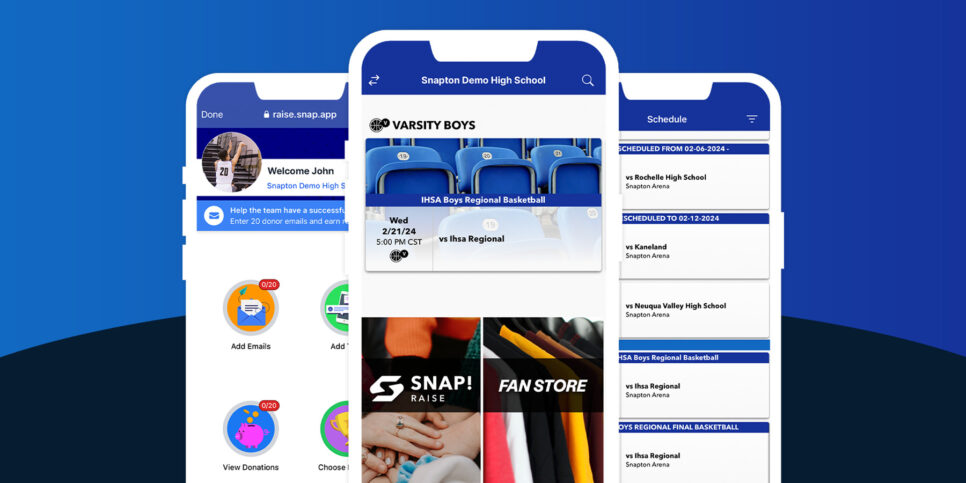

The Snap! Mobile app seamlessly connects to a program’s Snap! Raise fundraising campaign, Snap! Store, and engages...

Seattle, WA and Lincoln, NE: Hudl, the leader in sports performance analysis technology, has announced Snap! Raise...

As you gear up for another exciting summer camp season, say goodbye to scattered systems and stacks...

Plenty of youth programs need to fundraise to get the equipment, gear, and travel funds their groups...

As an Athletic Director, you’re constantly juggling multiple responsibilities. Managing schedules and staff, communicating with parents and...

Giving Tuesday is a global generosity movement that inspires hundreds of millions around the world to give,...

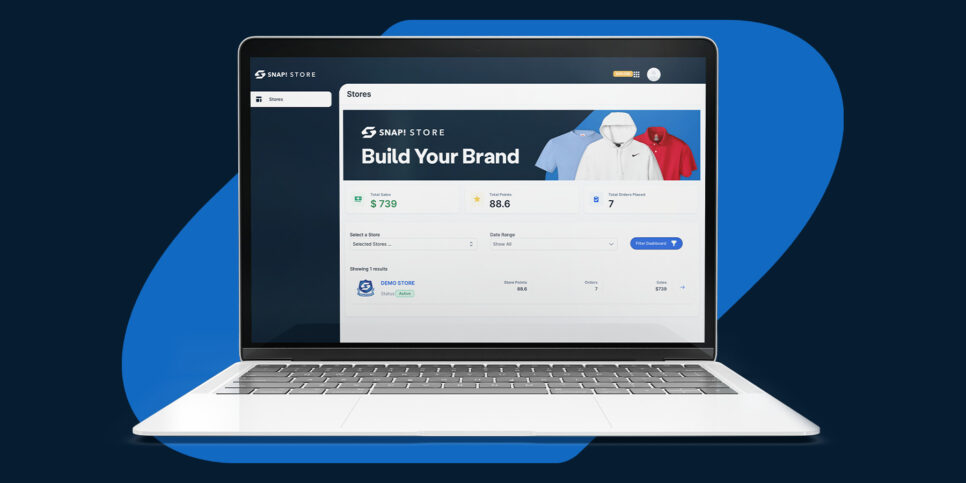

Customizing your Store and building your brand have never been easier. With the new Edit tab in...

We are thrilled to announce a new era at Snap! Spend, marked by a wave of improvements,...

Getting students into their FanX app is boosting activities opt-ins at Creighton Prep. Creighton Preparatory School, home...

Take a closer look at the FanX Rewards mobile loyalty platform and some of the positive results...

As part of our commitment to deliver the ultimate communication platform for you and your school, we’re...

Here at Snap! Mobile, we LOVE loyal fans! Our FanX™️ mobile platform was designed to easily and...

How can complete fundraiser oversight boost your fundraising efforts and strengthen your department? Snap! Insights is a...

Snap! Mobile, the nation’s largest online fundraising and program management platform for high school teams, clubs, and...

The Power of Snap! Store Snap! Store allows you to easily provide your community access to quality...

If you had extra funds, right now, for your program, how would you use them? With Early...

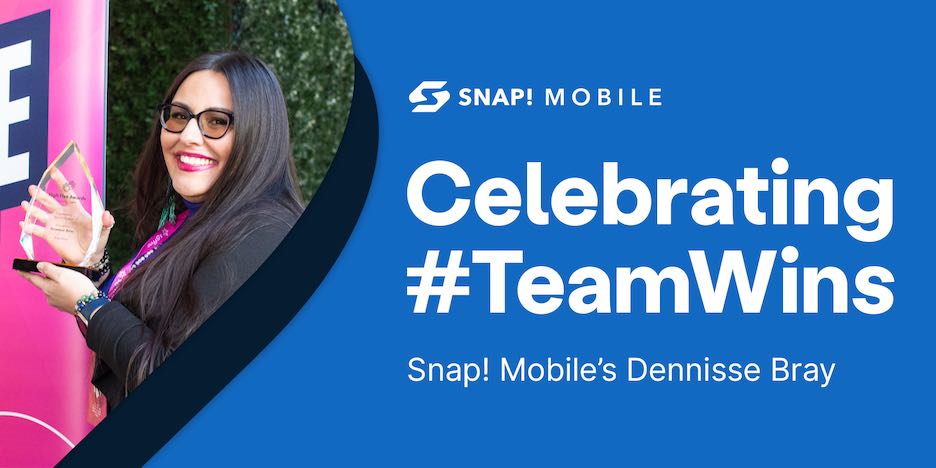

On November 18, 2022, Snap! Mobile’s Senior Human Resources Generalist, Dennisse Bray, was awarded the Community Champion...

1) Send out the parent letter before the fundraiser begins to set clear expectations. Starting a fundraiser...

One thing that few high school students enjoy is the fundraising necessary for a club or team...

The acquisition will enable school athletics and activities leaders to streamline their community engagement tools and partners...

At Snap! Raise, we’ve helped over 100,000 groups and teams raise funds to support their goals. Our...

With this list of fundraising do’s and don’ts, you’ll be able to avoid common pitfalls and get...

Bouncing between the many different fundraising platforms available today can cost you and your program time and...

Snap! Mobile, Inc., the parent company of the leading group-based fundraising solution, Snap! Raise, today announced a...

To help you get more of the funds you need, we have a couple of fundraising ideas...

Asking for donations can be a tough task for many, but it can actually be a simple...

With more and more virtual fundraising tools popping up every day, choosing the right online fundraiser for...

The COVID-19 pandemic has drastically and irrevocably changed a great deal about our lives, including the ways...

Is Snap! Raise Worth it? Snap! Raise is definitely worth it.

The Nova High School baseball team is not only well-known for its excellence on the field but...

For decades, schools and extracurricular programs were stuck fundraising the only way they could: by selling products.

When it’s time for school budget cuts, extracurricular clubs and activities often get the short end of...

What separates a winning fundraising idea from one that flounders? Getting too creative with your group’s time...

Snap! Raise Hires Stuart Silberg as Chief Technology Officer.

Snap! Raise is here to take the burden off your shoulders when it comes to your dance...

Snap! Raise is the only digital fundraising platform specifically designed to help educators and coaches build their...

Snap! Raise’s CEO, Cole Morgan, credits the company’s impressive growth to a team-wide commitment to driving the...

Howell, MI — In his first year at Howell High School, girls soccer coach Sean Rowser hopes...

Ms. Perry, a first-year teacher to second graders, is anxious about calling the home of one of...

Manage your program funds and support what matters with transparency.

After helping programs and teams across the country raise over $430 million, we know that the secret...

Musicians might have to work day jobs, but students in high school marching bands and orchestras shouldn’t...

When you think of school fundraisers, are bake sales and carwashes the first things that come to...

The Seattle-based fundraising technology company also ranked 2nd in the Pacific Northwest in its first year as...

The end of the school year is a funny thing. For months, it seems so far away....

The end of the school year might bring barbecues, picnics, travel, and relaxing in the sun. But...

Snap! Raise has helped raise over $46M for youth and high school football teams across the country....

After a school-best third-place finish in 2018, the Sumner boys set their sights on the Washington state...

Curious about QR codes? Have you been to a restaurant in the past year where you had to...

Snap! Raise was founded on the belief that “Every Kid Needs a Champion”: A coach, a club...

When kids play sports, it requires purchasing uniforms, safety equipment, shoes, and other gear. And often, the...

This Earth Day, Arrowhead High School Earth Club is focused on promoting environmental awareness at their school...

As a school leader, you know that communication is what connects your community with resources and community...

Snap! Raise digital fundraisers are intentionally designed to safely deliver group leaders more funds and take groups...

The secret to fundraising comes down to three magic words: before, more, and strategic. Jay Samit, Author...

Former Expedia Group VP joins nation’s leading digital fundraising company to expand the Snap! Raise e-commerce offering

Show support for your group & your planet.

As one of the fastest growing sports in the United States, cheerleading is no longer stuck on...

Band leaders, music directors, teachers, and parents supporting a youth band struggle to find a fundraiser that...

With a growing number of services that specialize in virtual and online fundraising, there is a lot...

They are the unsung heroes of the thousands of clubs and teams across the country we have...

“Just starting out one of your biggest strengths is, not knowing how things are supposed to be....

USA Weightlifting (USAW) raised $71,292 to support regional clubs and assist with national competitions in the lead...

Colorado Springs, CO. and Seattle, WA., December 7, 2020 — Glazier Clinics, the world’s largest provider of...

News Release: NFHS agrees to a multi-year corporate partnership with Snap! Mobile The National Federation of State...

In the past, parents and students organized booster clubs at the high school and college level to...

To be successful founding a company, you have to have a vision. You’ve got to believe strongly...

We kicked off 2020 by throwing out the old and bringing in the new: starting with our...

In 2019 we launched the very successful Smart Setup.

All Departments at Snap! Raise Hold to the Company’s Core Values

Many Snap! Raise employees are former athletes, so more than a few of us were coached by...

“Snap! Spend (formerly Growndwork) is a financial and spend management technology for groups and teams with built-in...

Snap! Mobile today announced its acquisition of sports fintech startup Groundwork, a pioneering financial management platform for...

“Groundwork (now Snap! Spend) is a digital banking and financial management platform.”

Band Fundraisers: 4 Steps to Success Fundraising for a school band takes time, patience, and vision. It’s...

There’s so much to think about when you’re planning the season for a travel or club sports...

Managing money for a youth sports team can be intimidating, especially if you’ve never done it before....

One of the questions we’re asked the most often here at Snap! Spend is, “Why should I...

Dealing with refunds is a common friction point between sports teams and parents.

Being part of a travel sports team is a serious commitment. Parents, coaches, and players all have...

As part of Snap! Spend’s goal to share best practices and help educate youth sports organizers, we’ve...

Youth sports clubs like soccer teams, baseball teams, or many other team sports often ask parents to...

In researching the best way to set up a team bank account for a youth sports team,...

Today I’m so excited to announce that Groundwork has been acquired by Snap! Mobile, Inc. makers of...

We’ve talked to hundreds of youth sports teams from every major sport and found that everyone struggles...

The team treasurer plays an important role in any youth sports organization.

Not so fast. Snap! Spend is a powerful tool that can help you achieve this, but only...

Booster clubs are becoming increasingly important to the operations of many teams and organizations. Because one of...

Playing youth sports is a huge part of our upbringing.

Whether it’s at home, school, or work, being organized makes everything easier. And sports teams are no...

Team fee collections are a big part of managing a club or travel team. Different sports have...

Collecting checks costs more than you may think, both in time and in money.

Snap! Store is your new online home for spirit wear, allowing you to promote your program in...

At Snap! Raise, we believe that "Every Kid Needs a Champion." Teacher Appreciation Week is a great...

June 2021: We're excited to enter our fourth season of podcast production at Snap! Raise.

8to18 and SchoolCNXT are now part of the Snap! Mobile family!

Acquisition Furthers Snap! Mobile’s Plan to Become the Only Full-Service Administrative Support Solution for High School Athletics...

In the wake of the Camp Fire that devastated Northern California in November 2018, the local community...

With five Texas 6A state championships in just 20 years (including three in a row from 2015-2017),...

Though school fundraisers serve a valuable purpose, even the best-intentioned fundraising efforts can cause a huge headache....

Three essential tips to get parents to read messages from their children's teachers.

Since the pandemic began, districts have changed their school engagement plans to meet a new world that...

Snap! Connect is a mobile and web-based family engagement app that connects students, guardians, teachers, and school...

Here are 7 easy cheer fundraising ideas to help your program raise more in less time so...

Crisis information and need-to-know alerts can dominate lines of communication between schools and families. These important missives...

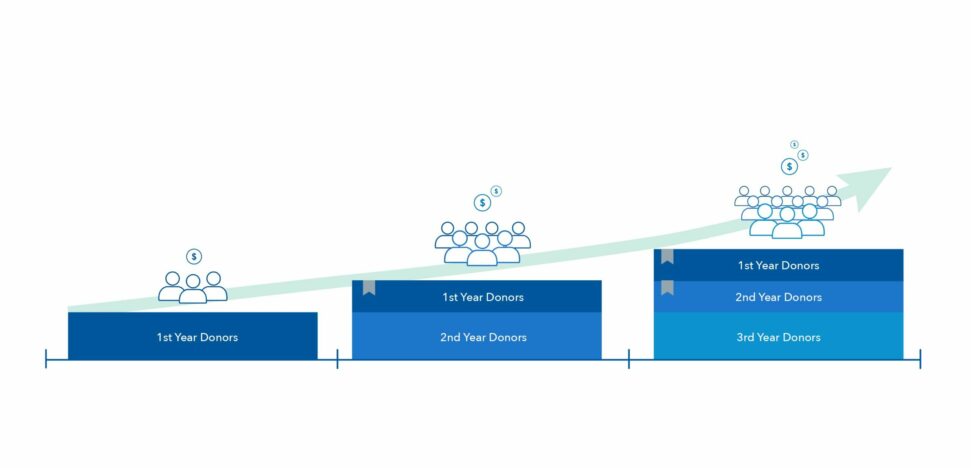

Grow your supporter base and confidently raise more every time you fundraise with Snap! Raise. Find out...

As we approach the 2022 National ESEA Conference, building family engagement in Title I districts and schools...

"In the past, you’d try to estimate how much you’ve raised. Insights is a quick, easy access...

In his TED Talk “The Way We Think About Charity is Dead Wrong", fundraising expert Dan...

Authority Mag is committed to sharing interesting, empowering, and actionable stories from influential leaders in Business, Film,...

From choir concerts, to art shows, to athletics day camps, events provide a great opportunity to raise funds by doing what your...

School administrators, coaches, teachers, and parents of middle schools struggle to find a fundraiser that brings in...

Brady is the CCO (Chief Canine Officer) at Snap! Raise. Here he explains why Snap! Raise, recently...

How does a school district communicate with its families? For some, this is a difficult question to...

Congrats! It is officially the home stretch of this school year! In the next few weeks, your...

Parental support and guidance are key contributors to a student’s motivation and engagement in school. When the...

Your students have taken exams, turned in projects, completed dozens of warm-ups and homework assignments, and now...

You think you are reaching all the families in your district - but are you? (Hint: you’re...

While many of us spend the month of December day-dreaming about long lazy days spent binge-watching favorite...

There are two words on every educator’s mind during the transition from summer to a new school...

Even the most respected and veteran teachers can use extra help in the classroom. Parent volunteers are...

Not all students learn in the same way. Not all students have the same abilities or the...

It’s that time of year already! Students are receiving their progress reports, but has your school checked...

There is no doubt that effective communications between parents and schools contribute to a student’s successful education....

As we start the new year with renewed energy, excited for what is to come, we would...

Winter break is around the corner! Thoughts are turning from lesson plans, grades, and tests to gifts,...

Writing celebrations. Classroom volunteers. Coat drive. Box tops. Homework help. So much comes along with being a...

A brand is not merely a logo, nor is it a glossy strategy to convince audiences to...

How do you build a strong school community when you’re only reaching half of the families? Short...

Have you ever conducted a group project in your class and then wished you could be a...

One of the most troubling issues facing school districts in recent years has been school staff shortages...

We've all experienced a rise in school communications sources in the past decade.

Every year, people make New Year's resolutions to improve their lives with commitments to bettering themselves. These...

Sometimes you feel like you’ve heard it all: they have to work, they can’t find a sitter,...

The recent school years have been emotionally draining with health stressors, social-political tension, and strained remote learning...

Before the school year begins many teachers are full of a sense of renewed excitement and commitment...

It is conference season for many schools. While conferences are undoubtedly a busy time for you as...

Fostering strong and effective communication among teachers, administrators and families is critical to student achievement and success....

When I was in 7th grade, I earned an ‘E’ in math. Not an ‘E’ for “exceeds...

In this age of technology, sending paper newsletters home with students is a defunct practice. To keep...

I was sitting in the staff lounge during my third week of teaching when I first heard...

The bulletin boards are up, your lesson plans are done, and you’ve completed your in-service days. This...

When you think about family engagement, what comes to mind? Probably coming to ‘Meet the Teacher Night’,...

Our goal as teachers is for our students to succeed. That may mean something different to each...